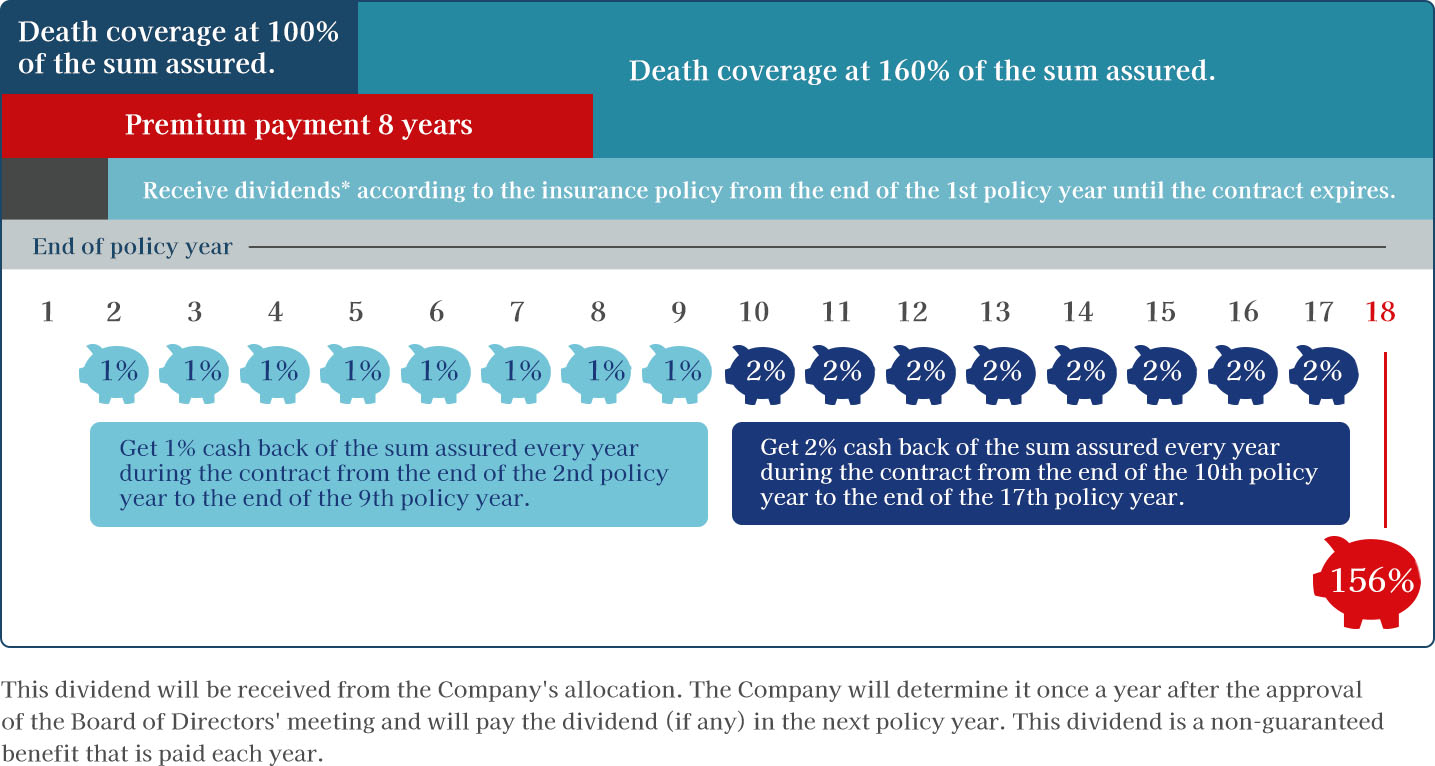

Sensible life insurance and medium-term savings, coverage is not too short and premium payment is not too long! Pay premiums for only 8 consecutive years, but receive protection in addition to continuous savings for up to 18 years, with the benefit of receiving continuous cash back every year from the end of the 2nd policy year until the end of the contract, up to 180% in total.

Pay annual premium by Kasikorn credit card or Krungthai credit card, pay 0% installment for up to 3 months.

Contact Customer Relations Tel: 02-033-9000

Note* For first year premium payment only. Buyers should always understand the details of coverage and conditions before deciding to purchase insurance.

| Example of coverage benefits for a female customer aged 30 years old. Sum assured 200,000 baht (excluding dividends). | |

|---|---|

| Details | Amount (baht) |

| Sum assured | 200,000 |

| Annual premium | 35,800 |

| Total premium payment (35,800 x 8 years) | 286,400 |

| Benefits if alive | |

| Receive 1% cash back of sum assured from the end of the 2nd – 9th policy year (total 8 times). | 16,000 |

| Receive 2% cash back of sum assured from the end of the 10th – 17th policy year (total 8 times). | 32,000 |

| Receive a maturity refund of 156% of the sum assured. | 312,000 |

| Total benefits refund throughout the contract. | 360,000 |

| Insurance age | 1 month 1 day – 65 years |

| Protection period | 18 years |

| Premium payment period | 8 years |

| Minimum sum assured | 100,000 baht |

| Insurance premium payment | Annual, 6-month, 3-month, and monthly basis |

| Attached supplementary agreement | Supplementary agreement can be purchased in accordance with the Company’s rules. |

Annual premium rate per sum assured of 1,000 baht

Annual premium rate per sum assured of 1,000 baht.

| Age (Years) | Female | Male |

|---|---|---|

| 1 month 1 day – 20 | 179 | 179 |

| 21 - 35 | 181 | 179 |

| 36 - 40 | 182 | 180 |

| 41 - 45 | 184 | 181 |

| 46 - 50 | 186 | 182 |

| 51 - 55 | 191 | 185 |

| 56 - 60 | 197 | 190 |

| 61 - 65 | 207 | 199 |

Note:

*This dividend will be received from the Company’s allocation. The

Company will determine it once a year after the approval of the Board of

Directors’ meeting and will pay the dividend (if any) in the next policy

year. This dividend is a non-guaranteed benefit that is paid each

year.

**Life insurance premiums (main insurance policy) can be used for

personal income tax deduction according to the actual amount paid, but

not more than 100,000 baht (under the rules of the Revenue Department).